Short-term rentals, multifamily, hospitality, and flexible living once operated as separate categories. That separation is breaking down.

Institutional capital is already responding. For investors, labels matter less than one core question. How do you increase yield without adding risk?

Supply has grown. Easy returns are gone. Regulation continues to tighten, raising the bar across markets. Demand for furnished, flexible living remains strong. Guests expect consistency. Owners expect durability. Professional standards keep rising.

Demand did not change. The ability to monetize it did.

This conversation explains how large-scale capital evaluates STR today. It shows why bolt-on models fail at scale and why flexible living is emerging as a structural shift, not a niche strategy.

STR is no longer about filling nights. It is about building institutional-grade operating models. Few operators are prepared for that reality.

STR Global Unlocked Podcast | Episode 16

EPISODE WITH JAJA JACKSON, SENIOR VICE PRESIDENT AT ICONIQ CAPITAL & CORPORATE DEVELOPMENT OFFICER AT SENTRAL

For years, Mom and Pop owners treated short-term rentals as a cash flow tactic. The logic was simple. Own property. Use STR to lift short-term returns.

That logic explains the early rise of Airbnb and similar platforms.

Institutional investors approached STR differently. They entered with larger portfolios and a narrower lens. The central question was not upside. It was income predictability.

That gap kept institutional capital and STR misaligned for years. The models did not fit. Today, both sides reached the same conclusion. Demand remains strong. The risk sits in how that demand gets monetized.

Many STR models break under that pressure. Jaja Jackson has seen this shift from every angle. He led large-scale residential property management before STR became a category. He helped shape Airbnb’s global professional host and multifamily strategy. Today, he operates on the institutional side, deploying capital while building Sentral as a flexible living platform inside Class A multifamily.

In this conversation, Simon Lehmann unpacks how institutional capital evaluates risk inside STR models. The focus stays on what investors remove. Distributed single-family portfolios add complexity. Lease arbitrage increases fragility. Incentives misalign. Bolt-on STR programs fail to scale.

When those variables disappear, the model changes.

Institutional capital anchors on long-term unfurnished units for stability. It layers midterm stays for repeatable upside. Short-term rentals sit on top as a managed and regulated component, not the thesis.

This shift extends beyond STR. It is reshaping how hospitality operates at scale.

In this conversation, we discuss:

Why institutional investors stayed committed to furnished demand while walking away from fragile STR models

Why easy returns for individual STR owners ended and what replaces them

Why midterm rentals emerged as the most scalable segment inside flexible living

How institutions underwrite STR as a controlled risk layer within multifamily assets

Why integration, operational discipline, and transparency outweigh ADR or length of stay

How flexible living shifts from a market trend to a structural change in global real estate

Connect with Jaja Jackson to learn more about Iconiq.

"It signals that this is something that must be understood for capital that wants to take advantage of this trend and that there´s a new way to live on planet earth"

Disclaimer:

The opinions expressed in this podcast solely represent the views of the respective speaker. Nothing expressed in this podcast should be viewed as investment advice or a recommendation to buy or sell any security, nor creates an advisory relationship with ICONIQ Capital. Nothing in this podcast constitutes accounting, legal, regulatory, tax, or other advice.

Key STR Trends

INDUSTRY CHECK-IN

Not as a debate about fighting or welcoming new rules. As an effort to understand what is already changing.

The challenge goes beyond a single policy move. New and existing proposals now touch taxation, pricing controls, local and national frameworks, and day-to-day operating requirements. Each layer increases complexity.

For responsible STR owners, staying informed is no longer optional. Keeping up across jurisdictions is hard.

Access to reliable information has improved. Operators now have clearer ways to track changes and assess risk.

This article examines how legislation shifted across U.S. states and cities. It also outlines what is likely to take shape in 2026.

READ THE FULL ARTICLE

Source: Rent Responsibly

Weekly News

WORTH A READ

Stay current on the industry. Each edition covers key insights, major headlines, and the technology shaping travel and short-term rentals.

Institutional investors banned?

President Donald Trump proposes limits on institutional purchases of single-family homes. The impact on STR could be significant. This piece explains how the policy may unfold

Cancun’s changing trends.

Occupancy across Cancún and Quintana Roo closed the year above 90 percent. Hotels captured most of that demand. Vacation rentals averaged near 58 percent. This analysis explains the gap.

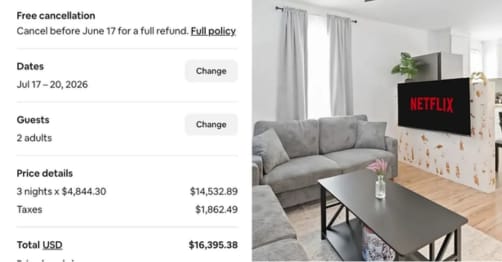

$17,000 a night?

The World Cup final is pushing Airbnb prices to new extremes. Owners are testing pricing ceilings. The open question is value. These listings show what guests actually receive.

CLOSING THOUGHTS

Short-term rentals are maturing fast. That maturity attracts institutional capital. What once worked as a standalone play now only works inside a broader, risk-aware real estate strategy.

Institutional investors are no longer chasing nights. They prioritize lower risk, resilience, and predictable income.

Flexible living matters when it adds yield without fragility or uncertainty.

This outcome is achievable. Many operators still miss it. Discipline draws the line.

Clear integration, operational transparency, and long-term alignment attract capital ready to engage. Others face a narrower path forward.

This newsletter and podcast are brought to you thanks to AJL Atelier.

AJL Atelier is a globally recognized consultancy, specializing in the Short-Term Rental (STR) industry, known for our unique blend of trend forecasting, consumer insight, brand strategy, and innovation.

If you liked this newsletter, share it with your friends!

If this email was forwarded to you, subscribe to our Beehiiv’s newsletter here to get the newsletter every week.