Capital still fuels growth. That has not changed.

What has changed is how hard it feels to access it.

Across the STR industry, founders keep asking the same question. Why does raising capital feel so draining?

Venture capital has slowed. Gatekeepers have increased. What once felt like a direct process now feels crowded and slow. For many STR founders, the friction is enough to raise real doubt. Is capital still there at all?

This week’s conversation offers a different lens. Capital has not disappeared. The system around it has failed to keep pace. And while that explains part of the challenge, STR founders cannot afford to wait for the system to fix itself.

STR businesses are still strong candidates for capital. But access now depends on readiness. Brand credibility matters. Clear positioning matters. Only a small group of STR companies are built well enough to move through today’s capital landscape with confidence.

That tension sits at the center of this week's episode.

STR Global Unlocked Podcast | Episode 15

EPISODE 15 WITH REBECCA KACABA, CEO & CO-FOUNDER OF DEALMAKER

It feels exhausting when it should not. Accessing capital should feel easier in an age shaped by rapid technological change. Every STR founder knows the reality. Reaching the moment when money and expertise flow into a company often feels like finishing a marathon.

Why does this keep happening? Not long ago, global disruption led many to believe capital had dried up. The assumption made sense when borders closed and markets froze. Today, founders face a different obstacle. More gatekeepers. More meetings. More interviews. More dead ends.

Here is the core issue. According to Rebecca Kacaba, capital never dried up. Rebecca is the CEO and co-founder of DealMaker, a platform that has helped companies raise over $2 billion online using modern capital raising tools.

Her perspective is clear. Venture capital failed to evolve.

Technology like AI transformed entire industries. Operations became more transparent and more data driven. Venture capital stayed behind. The process still feels opaque, manual, and inefficient. Founders know the pattern well. Endless pitching followed by silence. Calls, emails, and meetings disappear without resolution.

Rebecca works to change this dynamic through DealMaker. The focus stays on simplicity. Fundraising should resemble e-commerce. Equity becomes the product. Investors become customers. Over time, those customers turn into advocates.

STR businesses remain attractive candidates for venture capital. Pacaso offers a clear example after raising $72 million in funding.

STR founders still face a choice. Nothing comes automatically. Rebecca sat down with Simon Lehmann to stress one point. The STR industry must evolve rather than wait for venture capital to catch up.

Examples like Pacaso succeeded because they built a connected community of advocates first.

In this conversation, we discuss:

Traditional venture capital is no longer the only path. Online capital raising moves faster, brings more transparency, and gives founders greater control.

Community building, a clear willingness to market online, and real growth separate strong STR businesses from the rest.

Common early stage fundraising mistakes. These include unrealistic valuations and choosing capital structures that restrict flexibility.

How AI reshapes capital markets by reducing friction across compliance, verification, and investor onboarding.

"We say we make it as easy to sell shares online, as it is to sell shoes online."

Key STR Trends

INDUSTRY CHECK-IN

If one word defines a large part of the STR industry in 2025, it’s regulation. Shifting rules across cities worldwide have created pressure for operators, business leaders, property owners, and guests alike.

So what does it mean to work as a lawyer inside the STR industry while regulations keep changing? In a candid interview, Darrell Chan, Airbnb’s APAC General Counsel, explains why legal teams must stay flexible and ready for constant surprises. He describes the role in simple terms: guerrilla lawyering.

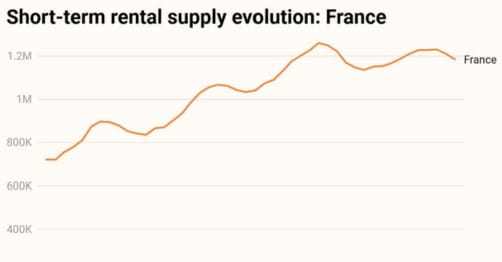

Source: Rental Scale Up

Weekly News

WORTH A READ

Stay on top of the industry. Each edition brings key insights, major headlines, and the technology shaping travel and short-term rentals.

Software defines success.

Portfolios with three or more properties perform better when they adopt software. The challenge is knowing which tools actually make sense.

What was the real impact?

Regulation dominates the short-term rental conversation. This article looks at what impact those rules have had in practice.

AI is good, but not too much AI

Tools for OTAs, property managers, and hosts keep multiplying. Growth helps, until volume creates friction. This piece explains how technology overload leads to stress.

CLOSING THOUGHTS

Raising capital often feels tiring and outdated. Founders feel the pressure, but stepping away isn’t an option. Capital still plays a critical role in growth.

That’s where the digital economy comes in. This week’s conversation reinforces a simple point. Capital exists, and technology keeps reducing friction across the process.

The responsibility now sits with founders. Preparation matters, so when conditions align, they are ready to move.

If you liked this newsletter, share it with your friends!

If this email was forwarded to you, subscribe to our Beehiiv’s newsletter here to get the newsletter every week.